Fintech startup N26 is trying to build the bank of the future, slowly but surely adding features to provide everything you’d expect from such a bank. N26 already offers consumer credit loans in Germany if you’re a creditworthy employee.

And starting today, N26 users who are self-employed, freelancers, students and more can also request a loan thanks to Auxmoney.

If you’re not familiar with Auxmoney, the startup matches individual lenders with individual borrowers. It’s a credit marketplace like LendingClub, Younited Credit and more. It’s not for everyone, but if you’re an unusual borrower, Auxmoney can help you.

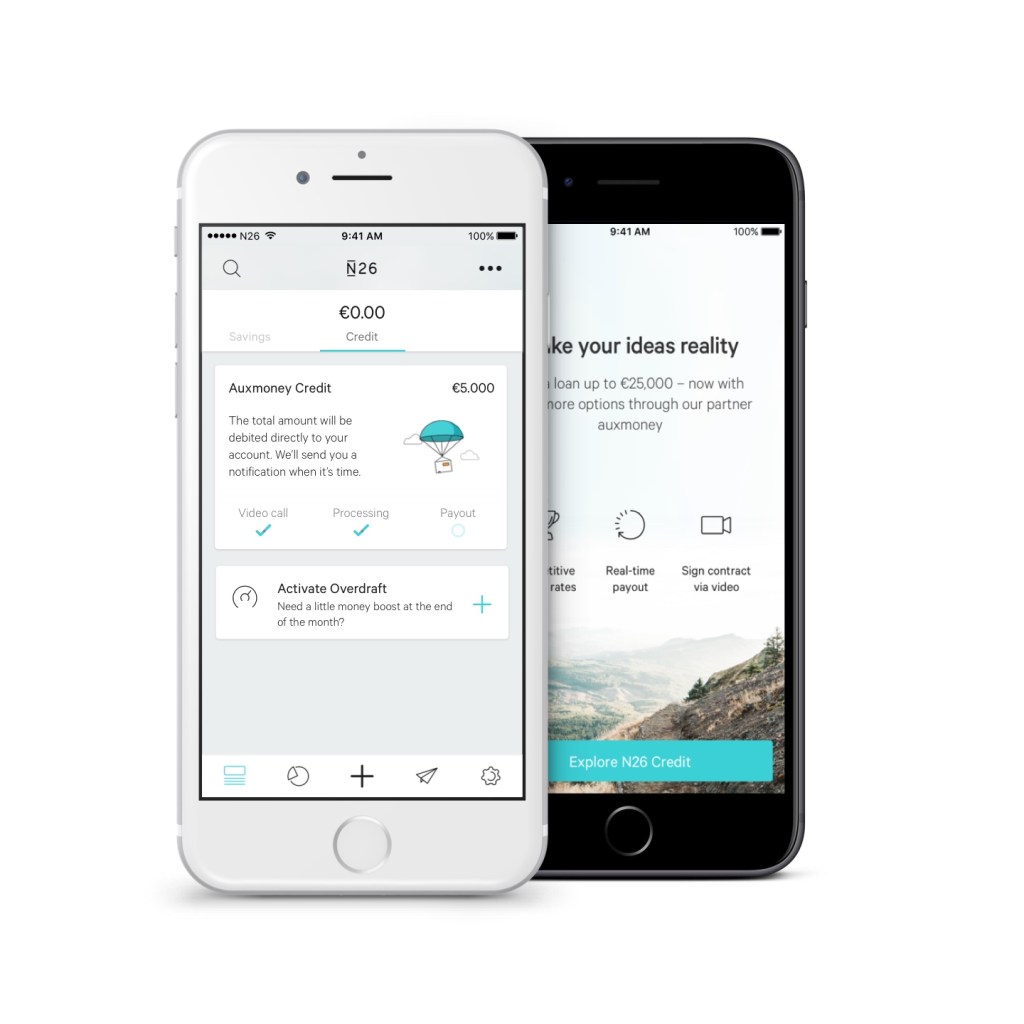

Now, if you go to the Credit tab in the N26 app, you’ll be asked how much money you want, the duration of the repayment and your current situation. Depending on your status, N26 will automatically suggest the best credit feature for you.

So if you’re a regular employee with a steady income, N26 will either give you money itself or match you with a third-party bank behind the scene. If you’re a freelancer, N26 will suggest lending money through Auxmoney.

Both products let you borrow between €1,000 and €25,000 at a duration of 1 to 5 years. It’s hard to tell you about interest rates as it’ll greatly vary depending on how much money you’re asking for and your situation.

This is a good addition as anyone can now open a credit line using N26’s app. You don’t need to open another bank account or sign up to a third-party — it’s a seamless integration.

Once again, this feature is limited to Germany. While it’s great to see that German customers can now invest, save and borrow money using N26, I hope that the startup is going to launch similar features in other markets as well. That’s how you build a truly European bank.

User Center

User Center My Training Class

My Training Class Feedback

Feedback

Comments

Something to say?

Log in or Sign up for free